Date: 29 Apr 2024

Aerospace & Defence

Sector |

Market Cap |

No of Companies |

Aerospace & Defence |

684113.8 |

22 |

NetWorth |

30670.85 |

TTM Sales |

64955.46 |

TTM Sales Var (%) |

6.02 |

Debt |

3838.21 |

TTM OP |

14915.93 |

TTM NP Var (%) |

16.66 |

Capital Employed |

37523.37 |

TTM OPM (%) |

27.92 |

EV/TM Sales |

10.53 |

Net Block |

12051.48 |

TTM PATM (%) |

18.28 |

EV/TTM EBITDA |

45.21 |

Current Assets |

52333.43 |

Debt / Equity |

0.13 |

P/E |

57.62 |

ROCE (%) |

128.02 |

RONW (%) |

38.71 |

P/B |

22.31 |

The above figures are in Rs. Crores as of 29 Apr 2024

TTM ended December 2023

|

29 Apr 2024 |

31 Mar 2023 |

31 Mar 2022 |

MoM Var. (%) |

YoY Var. (%) |

Sector Marketcap |

684113.8 |

257506.83 |

170204.16 |

165.67 |

301.94 |

Total Marketcap |

40881718.68 |

25956454.87 |

26857769.69 |

57.5 |

52.22 |

Sector's share |

1.67 |

0.99 |

0.63 |

0.68 |

1.04 |

Sector No of companies |

22 |

20 |

18 |

2 |

4 |

Total Listed companies |

4588 |

4285 |

4116 |

303 |

472 |

Sector's share |

0.48 |

0.47 |

0.44 |

0.01 |

0.04 |

|

26857769.69 |

|

|

|

|

Gainers |

| Company Name |

29/04/2024 |

28/03/2024 |

Var% |

| Cochin Shipyard |

1337.55 |

871.75 |

53.43 |

| Rossell India |

470.60 |

357.30 |

31.71 |

| Garden Reach Sh. |

1000.55 |

765.10 |

30.77 |

| Sika Interplant |

1973.00 |

1524.55 |

29.42 |

| Data Pattern |

3007.55 |

2422.05 |

24.17 |

Losers |

| Company Name |

29/04/2024 |

28/03/2024 |

Var% |

| Ideaforge Tech |

685.55 |

687.65 |

-0.31 |

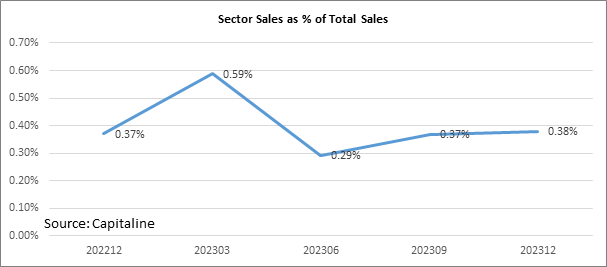

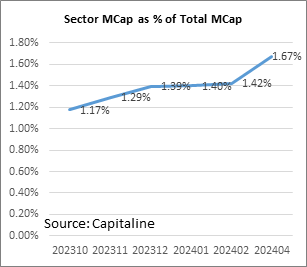

During the month of April 2024, Aerospace & Defence sector’s Marketcap increased 165.67% to Rs 684113.8 crore, compared to 57.5% rise in total listed marketcap to Rs 40881718.68 crore.

Sector’s share of total listed marketcap moved to 1.67% in April 2024 from 0.99% in March 2023 and 0.63% in March 2022.

In terms of price appreciation in the sector, there were 20 gainers and 1 losers in the month of Apr 2024. The gainers accounted for 90.91% of sector companies, losers accounted for 4.55% of sector companies, while 1% remained unchanged.

The top 3 gainers were Cochin Shipyard (53.43% gain), Rossell India (31.71% gain) and Garden Reach Sh. (30.77% gain).

Ideaforge Tech (-0.31% fall) was the only one loser.

Bharat Dynamics Ltd became ex-dividend.

During the month Sika Interplant Systems Ltd, BEML Ltd, Bharat Electronics Ltd, Taneja Aerospace & Aviation Ltd, Astra Microwave Products Ltd, Rossell India Ltd, Cochin Shipyard Ltd, Hindustan Aeronautics Ltd, Garden Reach Shipbuilders & Engineers Ltd, Mishra Dhatu Nigam Ltd, Bharat Dynamics Ltd, Zen Technologies Ltd, Solar Industries India Ltd, MTAR Technologies Ltd, Data Patterns (India) Ltd, NIBE Ltd, Apollo Micro Systems Ltd, Paras Defence and Space Technologies Ltd, Krishna Defence & Allied Industries Ltd, DCX Systems Ltd, CFF Fluid Control Ltd and Ideaforge Technology Ltd filed their shareholding patterns.

FIIs increased their shareholding in Data Patterns (India) Ltd from 6.74% to 14.57%, Cochin Shipyard Ltd from 4.10% to 5.23%, BEML Ltd from 9.12% to 9.91%, NIBE Ltd from 10.43% to 11.03%, Garden Reach Shipbuilders & Engineers Ltd from 2.87% to 3.26%, Astra Microwave Products Ltd from 2.94% to 3.17%, Solar Industries India Ltd from 5.90% to 6.10%, Apollo Micro Systems Ltd from 11.01% to 11.14%, Mishra Dhatu Nigam Ltd from 0.95% to 1.08% and Sika Interplant Systems Ltd from 2.60% to 2.64%. FIIs reduced their shareholding in CFF Fluid Control Ltd from 0.07% to 0.00%, Bharat Dynamics Ltd from 3.10% to 2.95%, Bharat Electronics Ltd from 17.78% to 17.56%, Paras Defence and Space Technologies Ltd from 0.49% to 0.13%, MTAR Technologies Ltd from 11.02% to 10.57%, Hindustan Aeronautics Ltd from 12.94% to 12.42%, Ideaforge Technology Ltd from 3.47% to 2.75%, Zen Technologies Ltd from 4.65% to 3.84% and DCX Systems Ltd from 6.75% to 2.30%.

DIIs increased their shareholding in Data Patterns (India) Ltd from 8.87% to 11.34%, DCX Systems Ltd from 7.31% to 7.91%, Hindustan Aeronautics Ltd from 8.64% to 9.10%, Cochin Shipyard Ltd from 2.17% to 2.41%, Zen Technologies Ltd from 2.53% to 2.68%, Garden Reach Shipbuilders & Engineers Ltd from 5.27% to 5.36% and Paras Defence and Space Technologies Ltd from 2.73% to 2.75%. DIIs reduced their shareholding in Solar Industries India Ltd from 14.78% to 14.17%, Mishra Dhatu Nigam Ltd from 11.76% to 10.94%, MTAR Technologies Ltd from 18.97% to 18.07%, Astra Microwave Products Ltd from 13.50% to 12.59%, BEML Ltd from 18.52% to 17.59%, Bharat Dynamics Ltd from 12.84% to 11.89%, Bharat Electronics Ltd from 21.97% to 20.95% and Ideaforge Technology Ltd from 5.88% to 3.76%.

Promoters reduced their shareholding in Taneja Aerospace & Aviation Ltd from 52.32% to 52.30% and Krishna Defence & Allied Industries Ltd from 73.38% to 61.29%.

During the month Annual reports of Sika Interplant Systems Ltd, BEML Ltd, Bharat Electronics Ltd, Taneja Aerospace & Aviation Ltd, Tata Advanced Material Ltd, Astra Microwave Products Ltd, Rossell India Ltd, Cochin Shipyard Ltd, Hindustan Aeronautics Ltd, Hindustan Shipyard Ltd, Goa Shipyard Ltd, Garden Reach Shipbuilders & Engineers Ltd, Mishra Dhatu Nigam Ltd, Bharat Dynamics Ltd, Zen Technologies Ltd, Solar Industries India Ltd, MTAR Technologies Ltd, Data Patterns (India) Ltd, Mahindra Aerospace Pvt Ltd, NIBE Ltd, Tata Advanced Systems Ltd, Apollo Micro Systems Ltd, Paras Defence and Space Technologies Ltd, Krishna Defence & Allied Industries Ltd, DCX Systems Ltd, Max Aerospace & Aviation Pvt Ltd, CFF Fluid Control Ltd, Ideaforge Technology Ltd, Gliders India Ltd, Troop Comforts Ltd, Horizon Aerospace India Pvt Ltd, Magnum Aviation Pvt Ltd, Aviasafe Aviation Services Pvt Ltd, Vertex Aviation Pvt Ltd, Innovative Aviation Pvt Ltd, Epsilon Aerospace Pvt Ltd and Vandana Aircraft Services Pvt Ltd were updated in Capitaline.